Blog

Common Pitfalls to Avoid in the Mortgage Process

Navigating the mortgage process can be a bit like walking a tightrope. On one side lies the dream of homeownership, and on the other, potential pitfalls that, if not carefully sidestepped, can turn...

Read more

What is the Difference between a 50yr, 30yr, and 15yr Mortgage?

To compare 50-year, 30-year, and 15-year mortgages, here's a breakdown of their key features and benefits:50-Year MortgageBenefits: Offers the lowest monthly payments compared to 30-year and 15...

Read more

Current Trends in the Fall Housing Market

As we move into autumn, the housing market is experiencing seasonal changes — it's cooler than recent years but remains active. The rapid price surges and intense competition of past years have...

Read more

Insights for Buyers During Homeownership Month

Celebrate Homeownership Month with Empowering InsightsJune is a wonderful time to celebrate Homeownership Month, recognizing the benefits of owning a home and supporting those ready to embark on...

Read more

Navigating Moody's Credit Downgrade: A Guide for Americans

Understanding the Economic Ripples: Broader ImpactsThe recent credit downgrade by Moody's has stirred a wave of concern among Americans. This significant shift from a pristine Aaa to Aa1 credit...

Read more

Key Considerations for Choosing a Mortgage Lender

Embarking on the journey to homeownership is an exciting yet complex process. Choosing the right mortgage lender is a crucial step that can significantly impact your home buying experience. Making...

Read more

10 Essential Facts About Reverse Mortgages

Confused about reverse mortgages? You’re not alone. With so much conflicting information out there, it’s natural to feel overwhelmed. Let’s clear things up with ten essential facts about reverse...

Read more

Comparing 30-Year vs. 15-Year Fixed-Rate Mortgages

Choosing the right mortgage can be a daunting decision for any homebuyer, especially with current high interest rates looming over the market in 2025. At present, nearly 90% of buyers are leaning...

Read more

What Credit Score do you Need?

If your credit score is hovering around 600, you might be wondering: Can I still buy a home in Texas? The good news is—yes, it’s absolutely possible. While a lower credit score can make the...

Read more

Down Payment Assistance

For many Texans, the dream of homeownership can feel just out of reach—especially when it comes to saving for a down payment or covering upfront costs. That’s where homebuyer assistance programs...

Read more

Mortgage Calculator

Understanding Mortgage CalculatorsIn the quest for homeownership, many Texas buyers turn to mortgage calculators to get a grasp on potential monthly payments. These tools are fantastic for initial...

Read more

Texas Mortgage Pre-Approval vs. Pre-Qualification

Understanding Pre-Approval and Pre-QualificationWhen you're planning to buy a home in Texas, understanding the distinction between mortgage pre-approval and pre-qualification is crucial. These...

Read more

Closing Day in Texas: What Homebuyers Should Expect from Start to Finish

Understanding the Closing ProcessClosing day is the final step in your home buying journey, and it's essential to understand what happens on this pivotal day. In Texas, the closing process involves...

Read more

Why Texas Realtors Choose MPS Mortgage for Fast Closings and Happy Clients

Streamlined Processes and Efficient ClosingsWhen it comes to closing deals quickly and efficiently, MPS Mortgage has become the go-to choice for Texas realtors. Our streamlined processes are...

Read more

Down Payment Myths That Stop Texans from Buying a Home

Understanding the Down Payment MythFor many Texans, the dream of owning a home seems distant, primarily due to misconceptions surrounding down payments. Contrary to popular belief, you don't always...

Read more

Why Working with a Local Texas Mortgage Lender Makes a Big Difference

Understanding the Local Housing MarketWhen you partner with a local Texas mortgage lender, you gain access to professionals deeply familiar with the state’s diverse housing markets. Texas is known...

Read more

How to Use Gift Funds for a Down Payment on a Home in Texas

Understanding Gift FundsWhen buying a home, particularly in Texas, using gift funds can be a viable way to cover the down payment. Gift funds are essentially monetary gifts provided by family...

Read more

Is Texas Still a Seller’s Market? 2025 Housing Market Update for Buyers

The Current State of the Texas Housing MarketAs we venture into 2025, the Texas housing market continues to be a focal point for buyers and sellers nationwide. Historically known for its robust...

Read more

Should You Refinance Your Texas Home in 2025? Here's What to Know

Understanding Refinancing: Is It Right for You?Refinancing a home can be an attractive prospect, especially when mortgage rates are fluctuating. It essentially means replacing your existing...

Read more

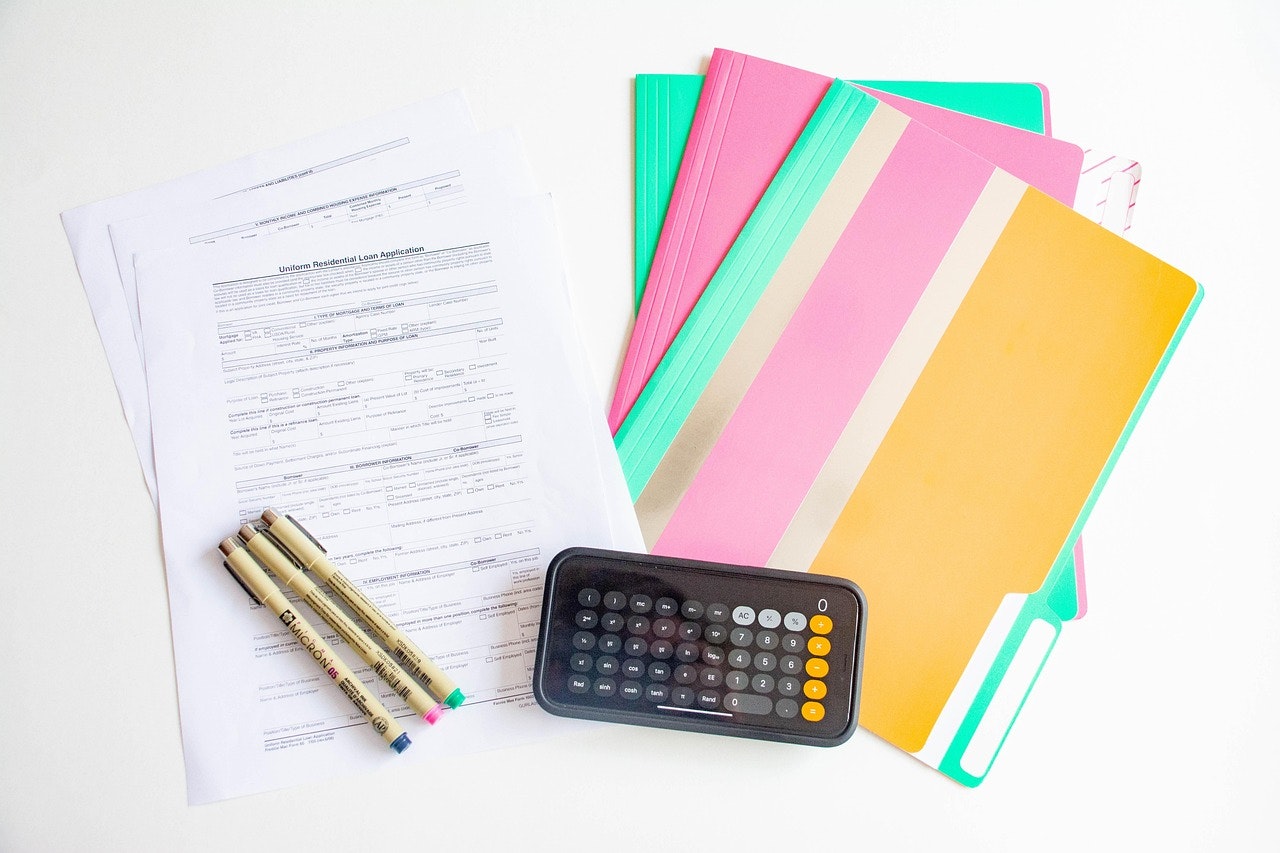

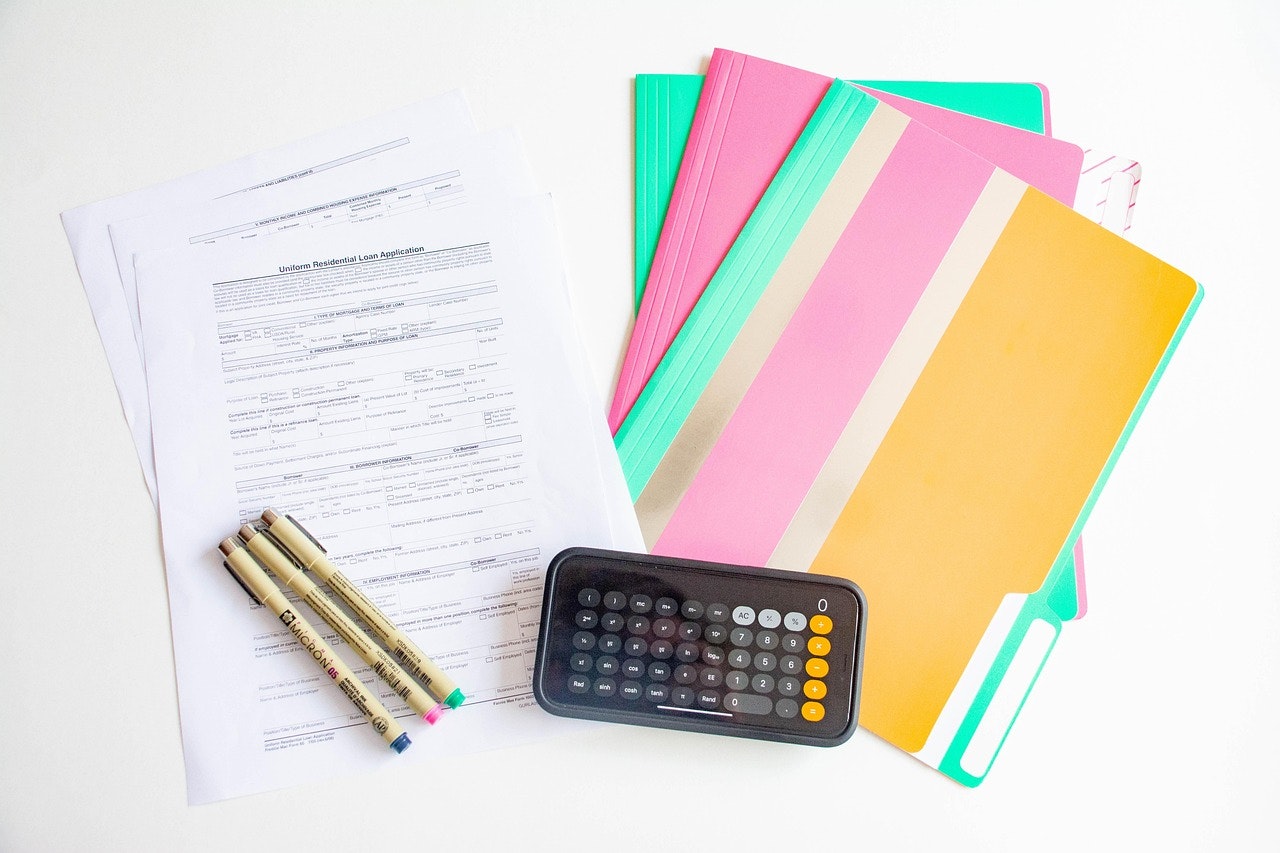

Mortgage Documents Checklist: What Texas Homebuyers Need to Close Fast

Understanding the Importance of Document PreparationClosing on a home quickly in Texas often hinges on having the right documents ready well ahead of time. Being prepared can significantly expedite...

Read more

How Your Credit Score Affects Mortgage Rates in Texas

Understanding Credit ScoresYour credit score plays a critical role in determining the mortgage rate you can secure, especially in a competitive market like Texas. Simply put, a credit score is a...

Read more

What Is an Escrow Account? Texas Mortgage Basics for New Buyers

Understanding Escrow AccountsIf you're new to buying a home in Texas, you might encounter the term 'escrow account' quite often. Essentially, an escrow account is a neutral third-party account...

Read more

Choosing the Right Mortgage for Financial Success

Selecting the perfect mortgage can be daunting, but it’s crucial for long-term financial success. A thoughtfully chosen mortgage aligns with your short-term affordability and long-term goals,...

Read more

Can You Buy a Home with Student Loans? Texas Mortgage Tips for 2025

Understanding the Intersection of Student Loans and HomeownershipNavigating the home buying process with student loan debt can seem daunting, but it's important to remember that owning a home is...

Read more

5 Common Closing Delays in Texas Real Estate (and How to Avoid Them)

IntroductionNavigating the real estate market in Texas can be both exciting and challenging. One of the most anticipated but often stressful parts of the process is closing on your new property....

Read more

What to Expect During Underwriting – A Texas Buyer’s Guide

Understanding the Underwriting ProcessThe underwriting process is a crucial step in securing a mortgage, especially in Texas, where real estate transactions are vibrant and varied. It's essentially...

Read more

How to Lock in the Best Mortgage Rate Today

Understanding the Importance of DocumentationWhen you're in the market for a mortgage, securing the best rate can make a significant difference in your financial future. One crucial step in this...

Read more

Understanding Appraisals in Texas: What Buyers Need to Know

Why Appraisals MatterAppraisals play a fundamental role in the home-buying process, especially in Texas. They serve as an independent assessment of a property's value, ensuring that the price...

Read more

Fast CTC

In the mortgage industry, achieving a "Clear to Close" (CTC) status signifies that all loan conditions have been satisfied, paving the way for the finalization of the home purchase. Accelerating...

Read more

Smart Home Tech: Features That Can Boost Your Home’s Value

Smart Locks: Convenient and SecureHomebuyers today are highly attracted to the convenience and security offered by smart locks. These devices allow homeowners to lock and unlock their doors...

Read more

Spring into Homeownership: Essential Buyer Tips

Spring is blooming, and so might your dream of owning a home. Known as the prime season for homebuying, springtime offers a lively yet competitive market that requires preparation and savvy...

Read more

Top 5 Tech Tools Every Homebuyer Should Use in 2024

The homebuying process has never been more tech-friendly. Whether you're searching for the perfect home, calculating your mortgage payments, or getting pre-approved, technology can make the process...

Read more

How to Get a Mortgage as a Self-Employed Borrower in Texas

Getting a mortgage when you're self-employed can be more challenging than for traditional employees, but it’s absolutely possible. Whether you’re a freelancer, business owner, or contractor,...

Read more

How MPS Closes on Homes in Texas Fast: 2 Weeks or Less

Closing on a home is often seen as a waiting game, but it doesn't have to be. In Texas, closing on a mortgage typically unfolds over 30 to 45 days due to lender requirements, appraisal timelines,...

Read more

Buying a Home in Texas vs. Renting: What’s the Better Financial Move?

Deciding between buying a home and renting is one of the biggest financial decisions you’ll make. In Texas, where housing markets vary from city to city, the right choice depends on factors like...

Read more

How to Ask Your Realtor to Find the House of Your Dreams

Understanding Your Dream HomeBefore you even approach a realtor, it’s crucial to have a clear understanding of what your dream home looks like. Consider factors such as location, size, style, and...

Read more

Maximize Savings with 1031 Exchanges & Opportunity Zones

Tax season often brings a sense of dread to many investors, with high tax bills looming as an unwelcome surprise. If you're feeling the pressure, you're not alone. Enter 1031 Exchanges and...

Read more

The Impact of Buyer Power on Market Dynamics

Understanding Buyer PowerBuyer power occurs when individuals or businesses purchasing goods and services have more influence over sellers than is typical in the marketplace. This shift in power...

Read more

Essential Qualities to Seek in a Mortgage Lender

Embarking on the journey of homeownership is both exciting and daunting. At the heart of this process is the critical decision of choosing the right mortgage lender, which can significantly...

Read more

FHA vs. Conventional Loans: Which is Right for Texas Homebuyers?

Choosing the right mortgage is a crucial step in buying a home. For many Texas homebuyers, the decision often comes down to FHA loans and conventional loans. Both have their advantages, but the...

Read more

Understanding Mortgage Interest Rates: What Affects Your Rate?

Mortgage interest rates play a crucial role in determining how much you’ll pay for your home over time. In Texas, like the rest of the U.S., interest rates fluctuate based on economic conditions,...

Read more

Are You Ready to Be a First-Time Homebuyer?

Understanding the CommitmentBecoming a first-time homebuyer is an exciting milestone, but it's also a significant commitment. Before you take the plunge, it's essential to evaluate whether you're...

Read more

Understanding the Vital LTV Ratio in Mortgage Lending

Navigating the housing market or seeking a mortgage can be challenging, especially when trying to secure favorable loan terms. Understanding key financial metrics is essential to making informed...

Read more

How to Get Pre-Approved for a Mortgage in Texas: A Step-by-Step Guide

Understanding Mortgage Pre-ApprovalGetting pre-approved for a mortgage in Texas is a crucial first step in the home-buying process. It not only provides a clear picture of your budget but also...

Read more

A Mortgage Primer for First-Time Buyers

Being a first-time homebuyer is a significant milestone, filled with excitement and anticipation. However, navigating the mortgage process can be daunting without the right information....

Read more

First-Time Homebuyer Myths

Buying your first home is exciting, but myths and misconceptions can cause unnecessary stress. Let’s clear up some common myths:Myth #1: You Need a 20% Down PaymentReality: While a 20% down payment...

Read more

Tax Refunds and How They Can Be Used to Buy a Home

Maximizing Your Tax Refund: Stepping Stone to Home OwnershipTax season can be stressful, but it can also present an excellent opportunity if handled wisely. For prospective homebuyers, utilizing a...

Read more

Why Pre-Approval is a Must

If you’re thinking about buying a home, getting pre-approved for a mortgage should be your first step. Pre-approval helps you understand your budget, strengthens your offer, and speeds up the home...

Read more

The Importance of Mortgage Prepayment: How It Can Save You Thousands

Many homeowners focus on securing a great mortgage, but prepayment strategies can significantly impact your financial future. Paying extra toward your mortgage can reduce interest costs and help...

Read more

Cash-Out Refinance vs. HELOC: Which One is Right for You?

If you’re a homeowner needing extra funds for home improvements, debt consolidation, or investments, you may be considering a cash-out refinance or a home equity line of credit (HELOC). While both...

Read more

Finding Your Perfect Mortgage Term: A Comprehensive Guide

When securing a mortgage, one of the biggest decisions you’ll make is choosing the right loan term. It's not just about picking between the well-known 15-year or 30-year options. Many factors come...

Read more

Choosing Your Mortgage Lender: Key Factors to Consider

Embarking on the journey of homeownership is a significant milestone. Part of this journey involves making informed decisions, and choosing the right mortgage lender is key. Selecting a lender...

Read more

Spring into Homeownership: Tips from a Mortgage Lender

Spring is a bustling season for those eyeing the dream of homeownership. As flowers begin to bloom, so too do opportunities to purchase property. With more homes entering the market, it's a prime...

Read more

Why Protest Your Property Taxes in Texas?

Property taxes in Texas can significantly impact homeowners, and many property owners often wonder if it’s worth the effort to protest. The simple answer is absolutely. Protesting your property...

Read more

Understanding Interest Rates and Mortgage Preapproval

Embarking on the journey to homeownership is an exciting yet intricate process. One of the pivotal elements in this journey is obtaining mortgage preapproval, which plays a crucial role in...

Read more

Texas Realtors: Why your listing and the right Lender Partnership is key

The Texas real estate market is shifting. While it still leans in favor of sellers, rising mortgage rates are impacting buyer demand. To close deals efficiently, you need a lending partner who...

Read more

Navigating FHA No Score Loans: A Guide for First-Time Home Buyers with Limited or No Credit History

Navigating the journey of home buying can be complex, especially for those stepping into the market with limited or no credit history. While traditional loans often require a robust credit history,...

Read more

Unlock Homeownership: How Down Payment Assistance Can Open Doors for You

The dream of owning a home is universal, but the journey to turning that key in your front door can be daunting, especially when it comes to the financial aspect. However, residents of Texas have a...

Read more

Maximize Your Homeownership Benefits with Mortgage Credit Certificates

Homeownership is a significant milestone, often accompanied by the challenge of managing mortgage payments and other related expenses. However, for Texas residents, the journey can be made smoother...

Read more